James Bouchard’s Surprise Bid for U.S. Steel

James Bouchard’s Surprise Bid for U.S. Steel: A Steel and Deal Maven James Bouchard, a figure deeply ingrained in

James Bouchard’s Surprise Bid for U.S. Steel: A Steel and Deal Maven

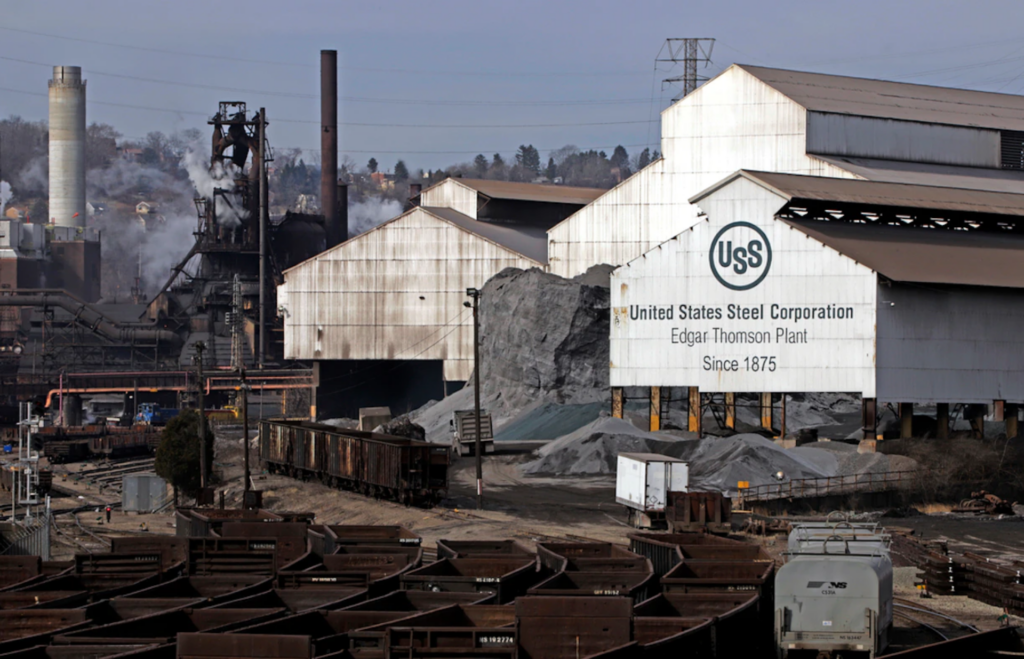

James Bouchard, a figure deeply ingrained in the world of steel and business transactions, has emerged with a remarkable $7.8 billion bid to acquire United States Steel. The investor, known for his keen acumen in the steel industry, as well as his history of successful acquisitions across various sectors, is aiming to usher U.S. Steel into a new era of success.

A Life Defined by Steel and Deals

Bouchard’s journey into the world of steel and business began in his formative years outside Chicago, where he was surrounded by steel industry professionals. Raised in a suburb neighboring a prolific dealmaker, Donald Kelly, who pioneered leveraged buyouts in the 1970s, Bouchard was exposed to the intricacies of dealmaking and industrial enterprises from an early age. He witnessed his parents’ work at a steel company, planting the seeds for his lifelong fascination with the steel business.

A Bold Offer for U.S. Steel

Now, with his own amassed fortune and a track record of successful acquisitions under his belt, Bouchard has put forward a substantial offer to purchase United States Steel for approximately $7.8 billion. He affirms that the funds are readily available, revealing that his industrial conglomerate, Esmark, is debt-free. Bouchard’s proposition is to acquire U.S. Steel without the need to borrow against Esmark.

U.S. Steel’s Transformation and Challenges

Bouchard’s interest in U.S. Steel is not only fueled by his affinity for the steel industry but also by his observance of the company’s struggle to operate its plants efficiently. U.S. Steel, one of the significant players in domestic steel production, has faced challenges keeping pace with more modern mills and efficient operations of newer industry contenders. Bouchard believes the company’s turnaround should begin with an emphasis on superior customer service.

A Vision for U.S. Steel’s Future

Bouchard envisions the key to U.S. Steel’s competitiveness lies in delivering a product within 24 hours, a strategy that aligns with modern industry demands. He underscores the significance of fulfilling customer needs promptly and efficiently. By focusing on customer service and operational efficiency, Bouchard aims to propel U.S. Steel back to the forefront of the steel industry.

A Competition for Ownership

Bouchard’s entrance into the race to acquire U.S. Steel came in response to a cash-and-stock offer by rival steel company Cleveland-Cliffs. Bouchard countered with an all-cash proposal, asserting his intent to keep the company unified and based in Pittsburgh. While he faces strong competition and uncertain odds, Bouchard’s history of successful turnarounds and acquisitions, coupled with his deep understanding of the steel industry, makes him a formidable contender in the race for ownership of U.S. Steel.

A Legacy in the Making

Should Bouchard’s bid succeed, his legacy will be etched alongside past giants of American manufacturing like J.P. Morgan and Andrew Carnegie. U.S. Steel, a historic symbol of American industry, could undergo a transformation under Bouchard’s leadership, carrying on its legacy into a new era of industrial prowess. As the bidding process unfolds and the future of U.S. Steel hangs in the balance, James Bouchard’s entrepreneurial spirit and expertise in the steel industry remain central to the unfolding narrative.*